- Bitcoin’s market value hits $1.87 trillion, surpassing Alphabet.

- Bitcoin rises 15% in April, decoupling from Nasdaq.

- Analysts see Bitcoin benefiting from capital outflows and growth.

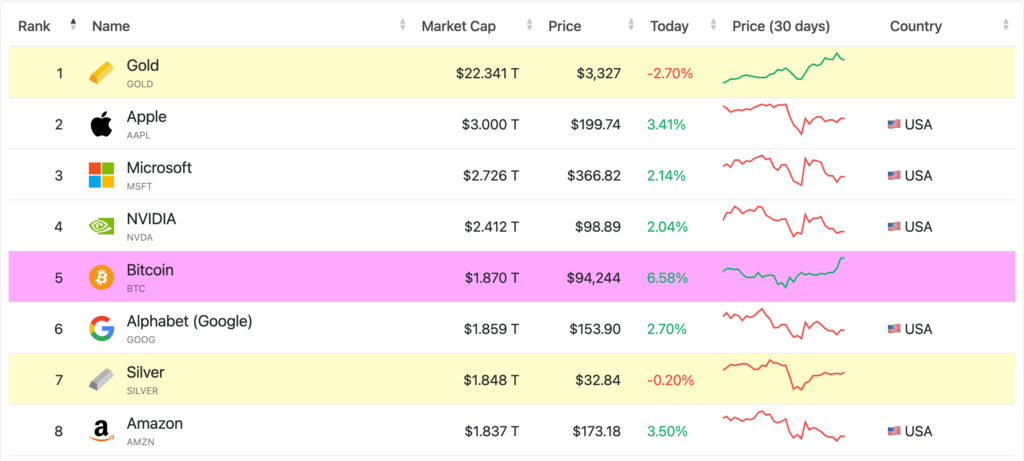

Bitcoin market value also surged 15% in April, compared to the 4.5% decline registered in the Nasdaq 100 index, which is rife with technology stocks. By virtue of this performance, Bitcoin has moved into the top echelon of the world’s five greatest assets, overtaking Alphabet (Google) to become the world’s fifth most valuable asset by capitalization.

Bitcoin Surpasses Alphabet to Reach $1.87 Trillion

According to data about assets, on April 23, Bitcoin had a market cap of $1.87 trillion, rising above Alphabet’s $1.859 trillion value. It holds fourth place in market value behind gold, Apple, Microsoft, and Nvidia.

That surge in Bitcoin’s price occurs as the cryptocurrency is also experiencing what is known as a “decouple” from its long-standing relationship to U.S. tech stocks. Instead, the cost of BTC went up 15% between April, while the Nasdaq 100 slipped 4.5%. It is another divergence for crypto enthusiasts after months of frustration for the trader, who had hoped for a more substantial rally after the United States’ presidential election.

The gains in April could not shake BTC down from 16% below its all-time high of $109,000, set January 20 when Donald Trump was re-inaugurated as U.S. president. The emergence of investor interest in cryptocurrencies has been rekindled as President Trump heavily criticized Federal Reserve Chair Jerome Powell a few days earlier and followed the other with an executive order to establish the Strategic Bitcoin Reserve (SBR), within 60 days of receipt as of the time the review period closes very close to within two weeks.

Fejau: Bitcoin Positioned to Benefit from Outflows

Good spillover on BTC as chatter on Fed independence rises, ex K33 head of research Vetle Lunde says. Fejau, the macro analyst, said it could also help BTC benefit from capital outflows from U.S. assets, as it is untaxed and has a high beta to portfolios not exposed to the current risks in U.S. tech stocks.

Fejau says, ‘This is what Bitcoin was built for this market regime.’ Once the ‘degassing’ kicks in, BTC should become the fastest-growing asset.

On the other hand, Alphabet has several problems, including regulatory and antitrust maltreatment and slow digital ad revenue growth. The number of AI-driven competitors and diminished growth projections further erode confidence in Google’s ability to retain its long-term dominance.

BTC now has a market value of $1.87 trillion compared to the combined worth of two Teslas. Electric vehicle giant has seen its holdings grow by about 180%, and that’s now worth over $1 billion along the way, adding BTC to its balance sheet in early 2021, in line with when the cryptocurrency was worth around $33,500.