- IBIT hit $643M inflow amid ETF surge.

- IBIT named Crypto ETP of the Year.

- Analysts warn of a correction despite the rally.

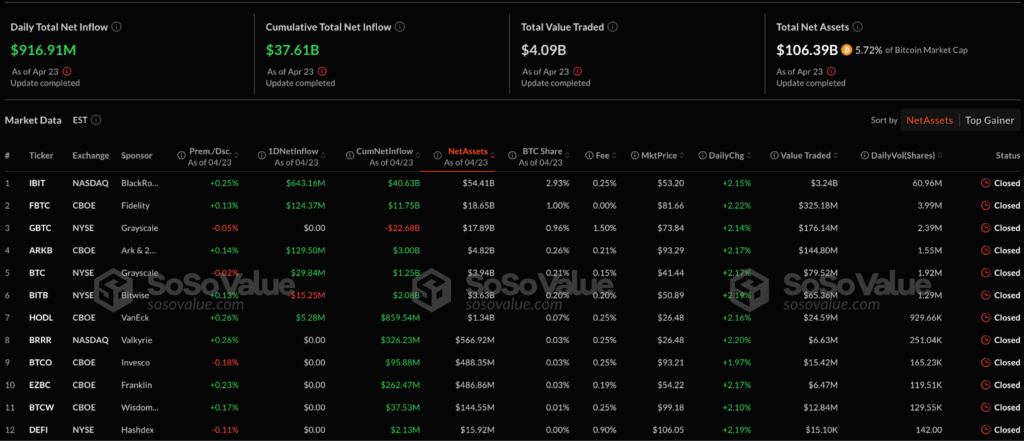

BlackRock’s iShares Bitcoin Trust (IBIT) posted a record $643 million in net inflows on Wednesday following the recent spike in macroeconomic uncertainty. This surge reflects increased institutional interest in Bitcoin ETFs. It is a new high for a single day of IBIT inflow after January 21 and reflects a broader rise in spot Bitcoin ETF demand.

In fact, total net inflows were over $917 million for the day, which, according to SosoValue, is one of the strongest institutional rallies since January. Bitcoin is reemerging as an investment that hedges against inflation and geopolitical instability, which flexes the muscle for it to develop among the populace.

Net inflows into Bitcoin ETFs in the four days leading up to the close of trading stood at $2.3 billion, almost double the volume seen in the 10 days before those ETFs’ debut in March. The sharp turnaround is attributed to surging investor confidence during ongoing economic stress by analysts, given Bitcoin’s prominence in institutional portfolios.

IBIT Crowned Crypto ETP of the Year

The inflow milestone also saw ETF.com name IBIT “Crypto ETP of the Year.” Its growing pile of awards gives the award another notch, with “Best New ETF” joining its list.

At $53.77 billion in assets under management, IBIT is now the largest among the eleven spot Bitcoin ETFs brought to the market by the proliferation of the product in January 2024.

Other ETFs also received heavy inflows on the day. For instance, ARKB by ARK & 21Shares saw $129.5 million added, while Fidelity’s FBTC swung with $124.37 million. In contrast to Bitwise’s (BITB), which took a net outflow of $15 million, VanEck’s HODL ETF (VADER) also experienced positive inflows.

April 23 proved significant not just for inflows but also for industry recognition. Furthermore, IBIT won two awards, one of the more prestigious awards provided by ETF.com, further adding to the reputation of the crypto ETF player as a significant power in this space. A Bloomberg analyst, Eric Balchunas, endorsed the honors on X, writing: ‘Feels like.’ “I know I voted this way.”

IBIT Hits $643M Inflow on April 23

On April 23, IBIT recorded $643.2 million inflow, which is only slightly lower ($661.9 million) than its peak of $661.9 million on January 21, a day when Bitcoin also peaked at an all-time high of $109,000 after the inauguration of Donald Trump to the office of president. Today, IBIT has run at an average of 45 million shares daily, each for about $53.20.

A new crypto ETF ticker, VanEck’s HODL ETF, was awarded ‘Best New ETF Ticker’, helping to revive the emerging crypto ETF scene.

The rally, however, has drawn strong inflows, and questions remain on the sustainability of this. Pointing out that it is ‘Some skepticism in the market, with some questioning whether this is the start of a structural decoupling from equity markets, or just some temporary divergence,’ some market observers expressed scepticism. As noted in a report on April 23 released by Bitfinex analysts, “We’re not quite there yet, but if Bitcoin can hold strength into upcoming CPI as well as Powell related and earnings volatility, the decoupling thing could go from ‘temporary divergence’ to ‘regime change.’”

Its short-term holder realized price stood at $91,000 recently, and it is trading near $93,754 today. The price has grown by 5.6% over the past 24 hours and is closer to 8% over the past month, crushing the performances of most traditional indices, including the S&P 500 and the Nasdaq.

But some analysts warn against a too optimistic mood. CryptoQuant contributor Avocado_onchain noted an increasing number of short-term holders [short-term holders between 1–3 months typically a precursor to market correction], and many of them sell when they create extra funds for buying. Historical trends show that this group only becomes long-term holders after a major pullback.

“The realized price level had already been surpassed quite a bit by Bitcoin when it hit its peak of $109,000 in January 2025,” the analyst added, adding that Bitcoin could be creating a double-top pattern. “It may be wiser for current holders to adopt a cautious approach rather than chasing the rally.”

Key factors still include macroeconomic variables. President Trump’s recent commentary that there would be a ‘substantial reduction’ of tariffs on Chinese imports fueled a risk of the rally. Still, the Xanrox analysts warned this may be a case of a ‘whale-driven trap.’

The Consumer Price Index (CPI) data for April is due for release on May 13, and all eyes are now on this data. Bitcoin’s trajectory has become further intriguing in light of March’s CPI, which came in at 2.4%, the lowest since February 2023.

To sum up, record ETF inflows, along with institutional accolades, which imply Bitcoin moves on from its veracity state, combined with macroeconomic risks and technical signals, are touted as reasons for investor precaution.