- PI tests $0.58 support as momentum weakens.

- RSI and MACD point to a bearish shift.

- Token unlocks raise dilution and price risks.

PI Network is still stuck in a tight sideways range, but its momentum signals start to weaken. This indicates a potential breakdown of the range and consequent dumping of the token as institutional fears regarding token dilution saturate the market sentiment.

PI Network Price Tests Lower Band Support Level

PI has been in a consolidation band since mid-April, with the band between $$0.59$$ and $0.67$$, which is a narrow, less than 14 % spread. The price is now on the lower range boundary, which could correspond to a move down to lower levels if the support is broken.

Technical indicators suggest a cautious streak. The Relative Strength Index (RSI) has fallen below 38, well below neutral 50, yet not quite oversold. At the same time, the Moving Average Convergence Divergence (MACD) indicator warns with early warning signals of a transition into bearish momentum. Although the MACD line is slightly above the signal line, the two lines converge rapidly, and a possible crossover may add to downside pressure.

Token Unlocks Add Pressure to PI Network Price

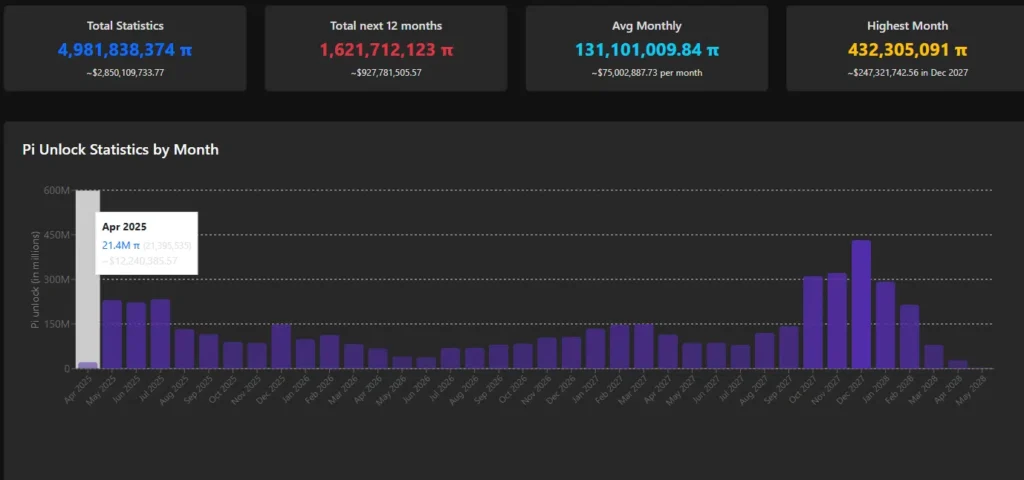

As token dilution fundamentals get a small step higher, this falls on a deteriorating technical background. In April alone, 21.4 million PI tokens, or about $12.3 million at current market prices, have been unlocked. While the monthly unlocking statistic sounds small, it is part of a larger trend that is contributing to the increase in the circulating supply. The average number of PI tokens that will be unlocked monthly in the upcoming 12 months will be more than 131 million.

Suppose the PI Network Foundation doesn’t publish a significant development update or chooses to burn sizeable parts of its massive aggregates (almost 72 billion PI (71,991,181,249 π) budgeted in its wallets). In that case, the possibility that it could stay from falling for a long time is high.