- SOL holds $149 support, showing bullish technical signals.

- Solana’s stablecoin market cap hits $13B, boosting network activity.

- ETF approval odds climb to 90%, fueling investor optimism.

Solana (SOL) is stabilizing around the $149 mark on Thursday after a rebound from its support at its 50-day Exponential Moving Average (EMA) on Wednesday. Solana’s stablecoin market cap jumps to $13 billion, indicating growing network activity, while technical indicators and on-chain metrics show this is a bullish trend. At the same time, Bloomberg Intelligence has increased the likelihood of U.S. regulatory approval for a Solana spot Exchange Traded fund (ETF) to 90% by 2025.

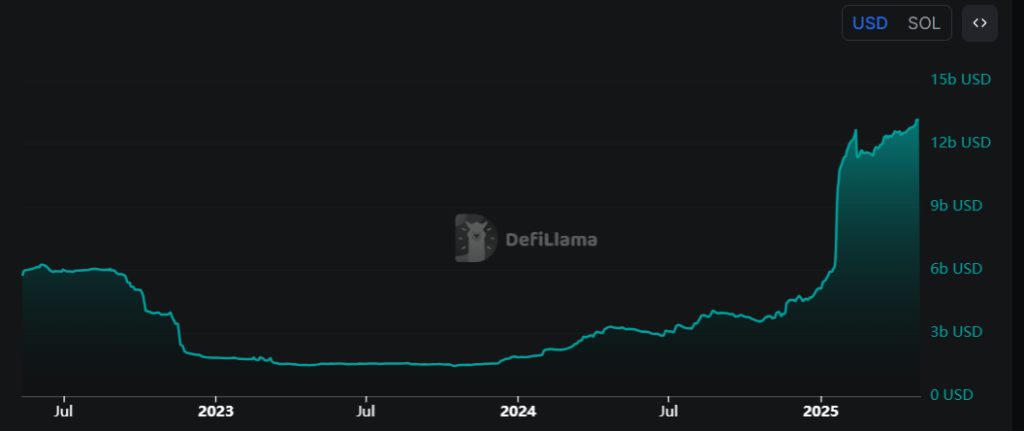

Stablecoin Activity on Solana Blockchain Continues Uptrend

Since early February, the value of stablecoins hosted in the Solana network has been consistently upward. Currently, data from DeFiLlama says that stablecoin is $13.06 billion. Expanding stablecoin value and increasing on-chain activity indicate a bullish trend for SOL, confirming growing blockchain utility. Innovation and profit are being made in DeFi, meme coin actions, or digital payment applications that are all drawing on demand and engagement in the network.

ETF Approval Odds Rise to 90%

With 90% likelihood it will be approved by the U.S. regulators by 2025, Solana spot ETF is the latest product to be added by Bloomberg Intelligence’s Alpha Edge ETF strategies group. That second analysis also finds that other cryptocurrencies, including Litecoin (LTC), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), Polkadot (DOT), Hedera (HBAR), and Avalanche (AVAX), all have approval odds above 70%.

Running the race with them are six big shop-based asset management firms who have filed applications for their Solana-based ETFs, which are now going through review with the U.S. Securities and Exchange Commission (SEC): Grayscale, VanEck, 21Shares, Canary, Bitwise, and Franklin. Interpreting the involvement of first class institutional players as a long term good sign for Solana is because that would mean being more accessible to mainstream investors and ultimately increasing liquidity. A formal approval on the ETF could legitimize SOL further within the financial markets, thus making SOL more attractive to a broader range of investor audience.

Technical Analysis: SOL Holds Key Support, Eyes Breakout

Last week SOL came up against some resistance around the $160 level, which caused a 5% pullback over the coming five days. And it also found key support coming in near the 50-day EMA of $140.30 on Wednesday. The price of Solana is currently less than $153, at the time of writing on Thursday. Supposing the 50 day EMA continues to act as a support level, and that SOL can close daily above $160, the uptrend may continue until the next resistance point at $177.66.

A bullish momentum is witnessed through the daily Relative Strength Index (RSI), now at 61, above the neutral 50 mark.

But if SOL cannot hold the support at the 50 day EMA and fall below $140.30, it may come under further pressure, dropping to $118.10 support.