- Kraken earned $471.7M in Q1 2025, with rising EBITDA and trading volume despite market headwinds.

- User accounts hit 3.9M, highlighting growth and engagement as Kraken expanded market share.

- NinjaTrader acquisition completed, pushing Kraken toward a multi-asset platform with new features and tools.

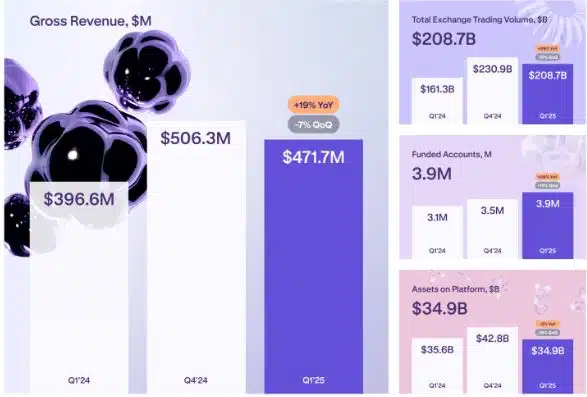

The prominent cryptocurrency exchange valued at over $20 billion, Kraken, has released its Q1 2025 financial report, outlining continued growth, strategic expansion in the face of broader market headwinds. In the first quarter, the exchange made $471.7 million in revenue, up 10% year-on-year from $396.6 million in Q1 2024, down from $506.3 million in Q4 2024.

Overall market activity softened, but the company also posted an adjusted EBITDA of $187.4 million, up 1% from the $185.7 million of the previous quarter, representing operational efficiency. In Q1 2025, Kraken’s total trading volume amounted to USD 208.7 billion, 29% above the total of USD 161.3 billion recorded in Q1 2024, but lower than the USD 230.9 billion recorded in Q4 2024.

Kraken Grows Market Share Amid Tough Conditions

The only bright spot was user growth, which rose to 3.9 million funded accounts (up from 3.5 million vs. 3.1 million at the same time this past year). Despite losing assets on the platform, which dropped from $42.8 billion in Q4 2024 to $34.9 billion, the platform’s growing user base suggests strong engagement and elasticity.

Kraken stated that it maintains and grows market share in a challenging environment. “We have built off a strong tailwind of 2024 momentum starting Kraken 2025 and took advantage of the changing and slackening markets to flourish in the volume share,” the company wrote in its update.

This is a huge strategic move for Kraken in a broad sense, as Kraken bought NinjaTrader, a TradFi known trading platform with huge derivatives trading capabilities. It is being referred to as a deal of this size, putting the trading worlds of crypto and traditional assets under a single roof. This will allow crypto traders on Kraken to use traditional derivatives and NinjaTrader users to get access to digital asset markets with familiar tools.

Kraken’s vision of becoming a fully comprehensive multi-asset trading platform for institutional and retail investors hinges on this acquisition.

Kraken Pay Launches with 300+ Currency Support

This has also impacted retail clients as multiple important features have launched in Q1. Introduced this quarter, Kraken Pay allows users to send instant payments over 300 crypto and fiat currencies. Furthermore, a newly created Kraken consumer app has tools to build wealth across multiple asset classes. Stake services have also ramped up, operating in 37 U.S. states and two territories, focused on compliance with regulations.

Both institutions and advanced traders have benefited from big platform upgrades. A high-performance FIX API for futures trading was rolled out, and the derivatives volume grew 250% month over month. Features like asset based cost basis tracking, average entry prices, unrealised profit & loss metrics and a customizable mobile user interface with multi chart views were driven by client feedback, and in response added to the Kraken Pro improvements. Additionally, OTC execution tools have been integrated directly into Kraken Pro’s interface for direct institutional access.

Completing another Proof of Reserves audit as of March 31, 2025, reaffirmed Kraken’s transparency commitment. The process allows users to verify their holdings through a cryptographically verifiable Merkle tree independently. Kraken had also pointed out that it was one of the early pioneers of Proof of Reserves and will now verify such tests quarterly.

While ARPU fell to $314 in Q4 2024, from $378 in Q4 2023, the exchange results imply growth and strategic adoption in the rapidly evolving market environment.

Now that the NinjaTrader acquisition is complete and the institutional grade tools are in place, Kraken looks ready to cement itself as much more than a cryptocurrency exchange but also as a leading multi-asset trading platform. It signals a long-term, through the current market cycles, strategy for being a viable company.