- AVAX is consolidating near $22, a historically strong rebound area.

- RSI and MACD show growing buying momentum despite short-term volatility.

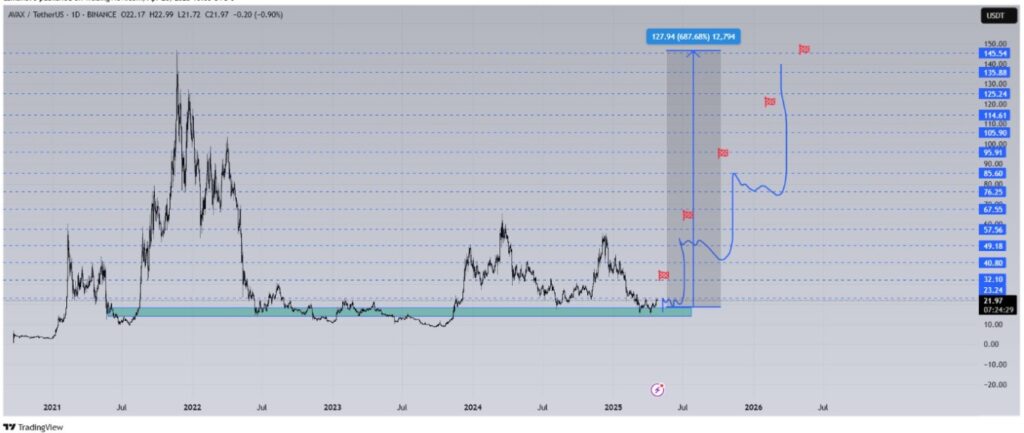

- Analysts forecast a breakout targeting up to $127.94 by mid-2026.

Avalanche (AVAX) is drawing heightened attention from investors and analysts alike as it trades near a crucial support level, showing signs of potential for a major breakout. Recent analyses, combined with its resilient market performance, suggest that AVAX may be entering a pivotal phase of accumulation and possible upward momentum. Despite short-term fluctuations and a slight trading volume dip, technical indicators reflect underlying bullish strength. As market participants closely monitor price action, the broader outlook for AVAX appears increasingly optimistic heading into the second half of 2025 and beyond.

According to KNIGHT, Avalanche (AVAX) may be on the verge of a major breakout, with projections indicating a potential surge of up to 687% from current levels. In a recent TradingView analysis, KNIGHT notes that at the moment, more than 60% of the price of Avalanche (AVAX) is being supported by the $22 level, which in the past has shown considerable buying pressure at this range. AVAX could rise up to $127.94 if the rally takes place, while the resistance points outlined are placed at $32.10, $49.18, $76.25, and above it. The indicators are, however, leaning on the side of a sentiment as the technical formation gives bulls a nod at current levels via an ascending triangle that seems to have a long-term breakout extending towards mid-2025 and into 2026.

Source: X

Current Avalanche price

During today’s trading session, the Avalanche (AVAX) coin remained relatively balanced and at the end of the day it increased by 0.55% in the course of the past 24 hours and is currently trading at $22.00. Market capitalization at $9.17 billion, 24-hour trade volume shrank by 28.83%, settling at $255.1m, indicating a lower volume of transactions.Avalanche maintains investor confidence, though market momentum appears cautious as volume relative to market cap stands at 2.89%. Investors are watching closely as AVAX navigates a critical consolidation phase.

Source: CoinMarketCap

Technical Indicators Signal Growing Bullish Momentum

The RSI is at 61.03; thus indicating bullish sentiment but not very high to indicate an overbought market. Also, the MACD shows a buy signal where the MACD is above the positive figure of 0.79 while the signal line is at 0.42. However, today’s decline is a minor one, which implies that the bullish momentum may keep gathering pace if the price stays above $22.00.

Source: TradingView