- Bitcoin nears $88K, but Arthur Hayes warns it may be the last chance below $100K.

- Timothy Peterson predicts Bitcoin could hit $138K in three months, driven by macro trends.

- With short-term volatility expected, Bitcoin needs to break $91K for a bullish confirmation.

Bitcoin got off to a good start for the week, gaining more than 3% and drawing close to the $88,000 mark. Bitcoin’s highest level in almost three weeks came when the cryptocurrency surged to $87,705 after the close of the Apr. 20 weekly period. While some market participants tagged the rally as the usual low-volume Sunday move, former BitMEX CEO Arthur Hayes was skeptical about the movement and called it a possible final opportunity to buy BTC before crossing $100K.

Bitcoin Could Hit $138K in Three Months

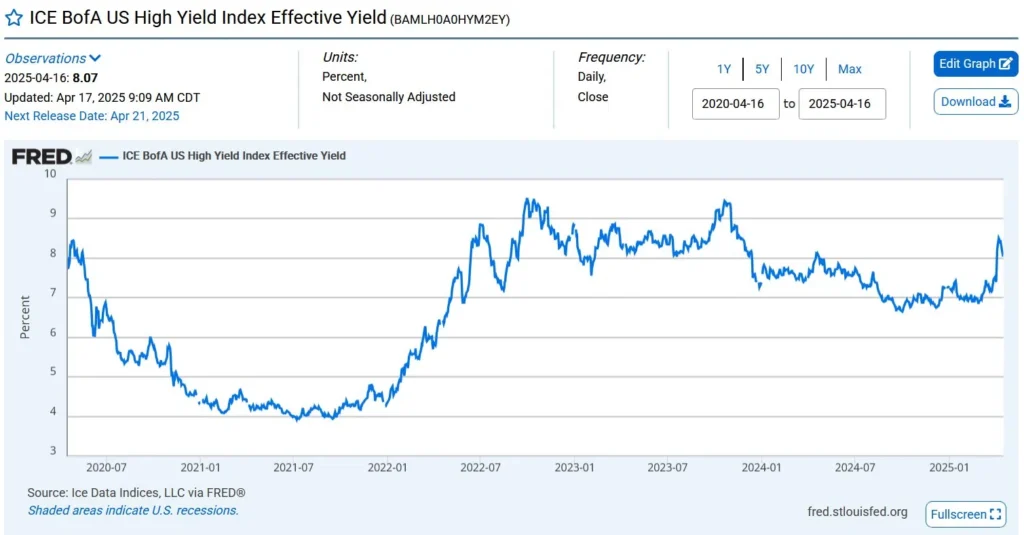

Economist Timothy Peterson recently predicted that Bitcoin would rise to $138,000 within three months, and he agrees with Hayes, pitching in his bullish stance. The pattern of Bitcoin rallying greatly when high-yield bond rates spike is historical, and Peterson bases his projection on that. Still, his data show that during such macroeconomic conditions, the cryptocurrency has made a median quarterly gain of 31% and in some cases, with much higher upside.

Then, gold prices are hovering near a record $3,400 per ounce, nearly 30% higher year-to-date and further adding to the optimistic outlook. Since the beginning of the year, Bitcoin has seemed to follow the path of gold, bringing back the age-old idea of BTC as ‘digital gold’, which had faded out to some extent in recent months.

At the same time, there is growing uncertainty over the Federal Reserve, which is fuelling the bull sentiment. Also, with Trump calling on Fed Chair Jerome Powell to be dismissed, eight Fed officials are set to deliver remarks this week under increased political pressure. The central bank is unclear about its next policy move, but market expectations are that the next rate cut will come by June. Such a move would cause the U.S. dollar to weaken, creating a stronger demand for other assets, such as Bitcoin.

Key Resistance Levels for Bitcoin’s Bullish Breakout

However, not all analysts are ready to believe that the current momentum will immediately cause new highs. Well-known market commentator Michaël van de Poppe stressed that weekend rallies usually don’t proceed further. He did say that such a move above $87,000 is encouraging, but warned that the market could rear back before a strong breakout. “I guess we’ll most likely correct back and just keep getting closer and closer to breaking through.” If the breakthrough comes, an ATH is coming,” van de Poppe said on X.

From a technical perspective, as data from CryptoQuant shows, Bitcoin needs to decisively move past $91,000 to confirm a bullish breakout. Until then, short-term holders, especially those who entered the market in the last six months, are at a loss. This dynamic may bring additional selling pressure and volatility in the short run.

Given the growing market dynamics and the changing macro keys, traders and investors are closely watching to see if Bitcoin is setting up for its next uptrend or if another downtrend is in order.