- Bitcoin’s MVRV ratio nears key levels, signaling potential for a major breakout.

- A golden cross formation could trigger another bull run, echoing past ATH surges.

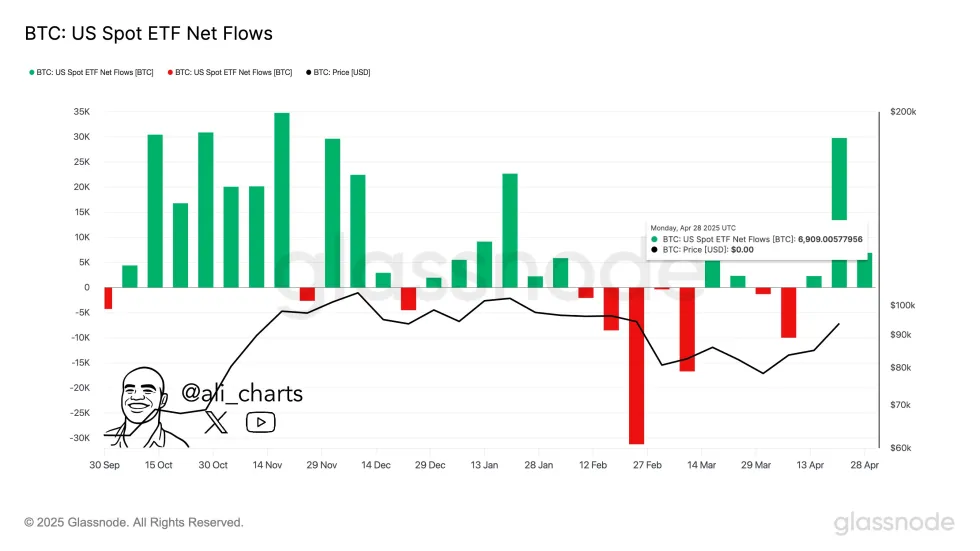

- Rising ETF inflows and institutional demand push BTC toward $97K resistance.

Bitcoin’s (BTC) recent price resurgence has reenergized a key on-chain metric closely watched by market participants: the Market Value to Realized Value (MVRV) ratio.

As Yonsei_dent reports in a CryptoQuant Quicktake post, the indicator has often indicated the beginning of big bullish trends in the past, so its current actions might indicate that BTC is ready for another huge breakout.

Bitcoin’s Surge Reignites Bull Market Speculation

Having dropped down below $74,508 on April 6, Bitcoin has since experienced a monumental rally that has put its value back over $90,000. The growing optimism of market analysts has been sparked by the price momentum as there are many people who expect a potential push towards a new all time high (ATH) in the near future.

According to Yonsei_dent’s analysis, Bitcoin consolidating close to $94,000 has allowed the MVRV ratio to come back and nearly reach the 365 day moving average (MA) of 2.15 at 2.12. This level has historically served as a bottom, a period when the BTC holders could take in major (currently 112% avg.) unrealized gains, closely cohering with strong bullish traction.

The report goes further to explain that a key technical formation may be forming as a “golden cross” is a typical formation if the 30 day MA crosses above the 365 day MA. This bullish crossover is a proven signal of a major rally in past cycles. The last such event in November 2024 did cause a surge, which led Bitcoin to set multiple ATHs in succession.

Though the setup for the bull run is bullish, Yonsei_dent warns investors to not get carried away. The analyst states that it’s imperative to keep an eye on the MVRV trend and that this will help to confirm the strength and sustainability of the move.

Bitcoin Nears Resistance Amid ETF Demand

Other prominent figures in the crypto space are also throwing up more additional insights. Crypto analyst Ali Martinez observed that Bitcoin exchange traded funds (ETFs) are resurfacing in a recent X post. Martinez said that ETF inflows have already amounted to over 6,900 BTC by this week, that’s a lot of institutional demand.

As for resistance, Martinez mentions $97,530 as a critical barrier for BTC to break through to really push its current ATH of $108,786, from which it was last touched on January 20, 2025.

Elsewhere, Titan of Crypto, a Bitcoin analyst, pointed out that the Bitcoin rebound off the orange line on the Golden Ratio Multiplier chart signals to him that such is a set up for an eventual move to the blue line target which, based on his understanding, would mean Bitcoin reaching as high as $125,000 in the near future.

Some long term projections are even more aggressive. A one forecast predicts the possibility of Bitcoin prices rising to $450,000 by the fourth quarter of 2025 if it follows the gold’s recent track record.At press time, Bitcoin trades at $96,049. Yet, with bullish technical patterns that are developing and institutional interest rising, the leading cryptocurrency is on the precipice for another key chapter in its ongoing rally.