- Although the economy has been a challenge, bitcoin hashrate reached a high in April.

- The April halving also worsened the miner profits as they plunged to the bottom.

- The area of hash power that is in the red isn’t even producing enough currency to stay afloat.

Mining firms are now selling off Bitcoin at a pace never seen before to offset plummeting profit margins, even as Bitcoin’s network computing power hits the stratosphere.

Bitcoin Hashrate Hits New Record in April Surge

In early spring of April, the Bitcoin network reached a powerful milestone. Data source BitInfoCharts shows that the hashrate peaked at one sextillion hashes per second on average daily on April 5, a record. On the verification of hashrate, computational activity on the network is on the surge, which is notable amidst broader economic pressures.

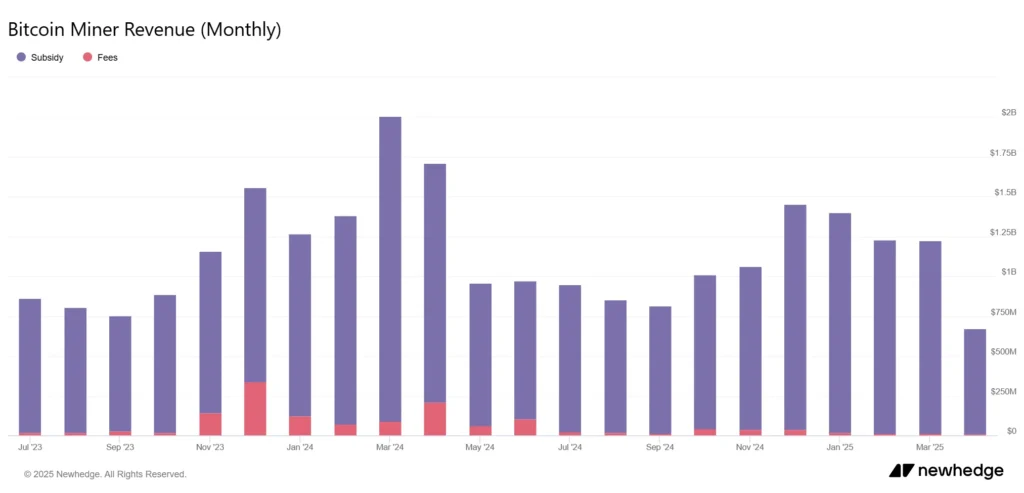

However, the network performance has increased even while the miners still can’t afford to give up. Blockchain analytics provider Newhedge said that mining revenue in March 2025 plunged almost 50 percent to just $1.2 billion, compared to March 2024.

Bitcoin miners generate several types of income subsidies from block generation and transaction fees. However, after April’s halving, which scaled down block rewards to 3.125 BTC, transaction fees have become increasingly important. Despite this shift, the fee volumes are still relatively low, and most of the blocks being processed contain no or few transactions, thus further pressuring miners’ profit margins.

Miner Sell-Offs Reach Highest Since October

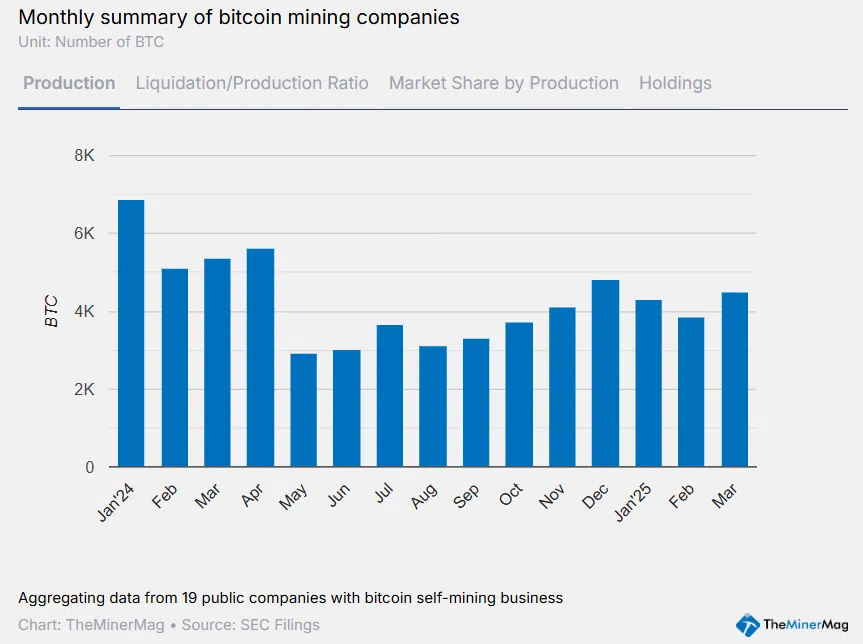

According to TheMinerMag, a sell-off trend is being observed. The highest sell rate for publicly listed mining companies since October 2024 was when they disposed of more than 40 percent of the Bitcoin they produced in March. This follows a rise in sales, TheMinerMag said, suggesting ‘that perhaps miners are heeding to increasingly tight profit margins as persistent low hash price levels and growing trade war uncertainty begins to damper.’

Even that benchmark was exceeded by some of the mining firms! The report says that companies like HIVE, Bitfarms, and Ionic Digital sold more than 100 percent of their March Bitcoin output, which would mean they are drawing from reserves. Meanwhile, companies like CleanSpark are twiddling their strategies based on a changing market environment.