- Bitcoin rebounds above $78K after falling below $75K on April 6.

- Active addresses and transaction volumes show signs of market slowdown.

- $80,000 remains a critical price point for Bitcoin’s short-term future.

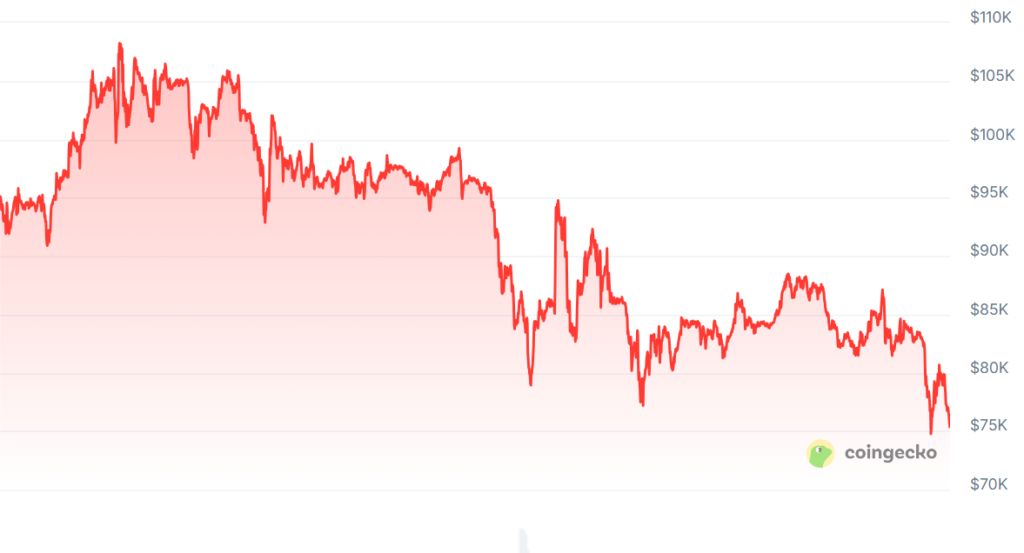

Bitcoin (BTC) price experienced major fluctuations in early April 2025 after a drop below $75,000 on April 6. The dip was in tandem with widespread market downturn in traditional assets such as the S&P 500. BTC price declined to $74,440 but it quickly recovered to surpass $78,000.

On-chain data demonstrates that Bitcoin’s transaction volume and active address level experienced variations in the last 12 months. Transaction volume reached its highest point in mid-2024 and December 2024 but experienced drastic decreases in 2025. The reduced market volume indicates traders have lost interest and are waiting for new driving factors.

Bitcoin at Critical Support: Analysts Eye $80K Level

Ali Martinez, a prominent crypto analyst, shared his analysis which indicates that BTC is currently testing crucial support levels at $80,000. If BTC fails to hold above this support levels its price see further decline. However, if BTC maintains above this level it could push it to $91,000 mark.

Historical data shows that BTC price surges after major market corrections . Mister Crypto, another crypto analyst emphasized that the current BTC price movement shows a consolidation pattern similar to its 2020 market pattern which preceded a increase in price. Market participants are continue to observe the situation to detect when prices will break past the current resistance levels.

The current BTC price movement indicates an important decision point and potential short-term market turbulence. Any potential Bitcoin recovery requires BTC to continuously hold support above $80,000. However, additional short-term price declines could occur if Bicoin does not hold the current price level .

The correlation between BTC and traditional assets changed when the S&P 500 reached its lowest levels in January 2024. Historical data shows that BTC maintains small correlations with traditional market movements. The future price movements of BTC could break free from traditional market patterns over time.

The market focuses on on-chain metrics to predict Bitcoin’s future price movements. BTC shows favorable technical conditions for a possible upward trend as long as its maintains the current support levels. Analysts continue to evaluate these market indicators to determine whether Bitcoin may experience a price gain or encounter more downward movement.

BTC faces difficulties to sustain its growth momentum because of the broader market instability. The Bitcoin’s future depends on traditional market conditions and on-chain activities. Future market dynamics will show whether BTC recovers completely or if it experiences additional losses.

As of this writing, Bitcoin is trading at $76,214.